How are penalties calculated for late registration as an Art Market Participant?

A new financial reality for some Art Market Participant (“AMP”) businesses in the UK is paying a penalty for late AMP registration with HMRC, the regulator.

While unregistered businesses might want to avoid such a fine, the reality is that it is illegal to continue ‘relevant activity’*, your business will be publicly listed on gov.uk as having received a fine and, moreover, if you voluntarily register, you’re eligible to receive a 50% discount on any penalty (not applied to the administration charge).

*Relevant activity: 10K+ EUR transactions in ‘works of art’ if you’re operating as an AMP and your business is in the UK, regardless of the client’s location.

Important note: The example provided below is of a ‘Penalties Calculation Schedule’. This is HMRC’s explanation of how the provisional penalty has been calculated and is not yet payable. The AMP business has a right to appeal the proposed penalty.

Please read before reviewing the example: Only one of Stage 1 or Stage 2 will apply, and not both – better yet, it’s whichever is the lower figure. The Stage 2 table is applicable for the majority of micro art businesses, for which you want to look at the gross profit on your overall business activity (i.e., including ALL business activity, regardless of it being caught under the purview of AML) and see the corresponding penalty under the column headed ‘Amount’.

What is the ‘most recent accounting period?

This is either the most recently filed accounts OR those for a more recent financial year that hasn’t yet been filed, but for which your figures have been finalised.

How do you calculate ‘gross profit’?

See HMRC’s guide – and note that it will be closer to what you know to be ‘net profit’. https://www.gov.uk/hmrc-internal-manuals/economic-crime-supervision-handbook/ecsh82815

Penalties Calculation Schedule

Company name: Art Gallery Ltd (the Business)

Penalty under The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (the Regulations).

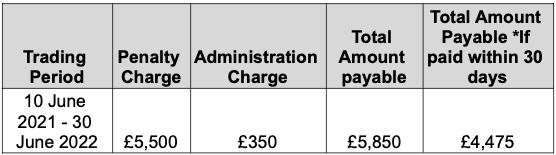

Table indicating the total charges applied

The total amount to pay is £5,850.

*A 25% reduction will be applied if this penalty is paid within 30 days. This means the total amount to be paid will be reduced to £4,475.

How the Penalty Charge is calculated

The penalty charge is calculated in three stages and we charge the lower of stage 1 or 2 plus any stage 3 supplement:

- Stage 1 is based on the length of time the Business has been trading unregistered up to a maximum of 5 years.

- Stage 2 is based on latest trading gross profits of ALL activity by the Business.

- Stage 3 is a £200 supplement which is applied if the Business has been trading whilst unregistered for longer than 12 months.

Stage 1

In stage 1 we consider the period of time that the Business has been trading whilst unregistered. We divide this into quarterly trading periods (3 months each). We then apply a £5,000 penalty for each 3-month period (and part thereof) a business has been trading whilst unregistered. This is capped at 5 years or 20 quarters.

The Business has been trading while unregistered from 10 June 2021 to 30 June 2022. This equates to 5 quarterly trading periods.

Therefore, the initial stage 1 penalty calculation is 5 x £5,000 = £25,000.

[OR]

Stage 2

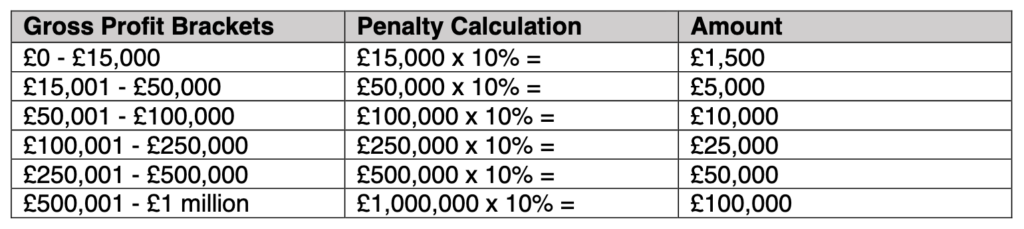

Gross profit for the AMP activities of the Business is used for the second stage of the calculations. The gross profit is categorised into the following brackets. Whichever gross profit bracket the Business falls within, 10% of the upper limit of the bracket is the stage 2 penalty.

The Business has confirmed that its gross profit of its AMP business [for the most recent accounting period] was £87,342.18 which sits in the gross profit bracket of £50,000 – 100,00.

Therefore, stage 2 of the penalty calculation is 10% of £100,000 = £10,000.

As stage 2 is the lower of the two calculations, we use this as our starting point when calculating the penalty charge. In this case this is set at £10,000.

Stage 3

If the Business has been trading whilst unregistered for longer than 12 months, a £200 per quarter supplement will apply to any 3-month period up to the capped 5 years. This forms the third part of the penalty calculation.

This means the supplement is £200 for each of the 5 quarterly trading periods. As this is less than a 5-year period the cap does not apply.

Therefore, the stage 3 penalty calculation is 5 x £200 = £1,000.

The starting penalty value is calculated based on stage 2 + stage 3 of the calculation: £10,000 + £1,000 = £11,000.

Reductions

There is a tariff of 50% reduction to be applied to the starting penalty value, where the breaches have been disclosed by the Business without being prompted.

This breach has been identified as being unprompted as the Business provided a late application for registration to HMRC on its own admission. Therefore, this is considered an unprompted disclosure and a reduction of 50% has been applied.

Conclusion

The Penalty Charge is calculated based on stage 2 plus stage 3 of the calculation, minus the 50% reduction as follows:

£10,000 + £1,000 x 50% = £5,500.

This means the total penalty, not including the £350 administration charge, is £5,500.

Please do not make any payment unless the final decision is to impose a penalty. Payment details will be given in the Penalty Notice if issued.

Full details on how HMRC calculates penalties for breaches of the Regulations can be found at https://www.gov.uk/hmrc-internal-manuals/mlr1-penalties-guidance/mlr1pp15090

![ArtAML logo - transparent.png]](https://knowledgebase.artaml.com/hs-fs/hubfs/ArtAML%20logo%20-%20transparent.png?height=50&name=ArtAML%20logo%20-%20transparent.png)