What is Customer Due Diligence (CDD)?

And is Simplified Due Diligence (SDD) an easy way to meet AML requirements?

If you’re subject to anti-money laundering (AML) legislation, you’re required to take steps that will raise red flags to signal the possibility of your business being the target of money laundering activities.

The level of compliance checks undertaken will depend on the level of risk, which can be any of three options:

- Simplified Due Diligence (“SDD”)

- Standard Due Diligence

- Enhanced Due Diligence (“EDD”)

Whereas Standard is most commonly undertaken, some findings might trigger the need to do EDD. In such cases, you conduct CDD and then EDD to address red flags that have been raised, for example:

- It turns out that the buyer is a Politically Exposed Person (PEP);

- Their primary residence in a ‘High Risk Country’; or

- They’re noticeably reluctant to provide information needed to conduct your AML / compliance checks, such as proof of address.

What the BAMF Guidance says:

“Lower risk/simplified customer due diligence

5.190 Many customers, by their nature or through what is already known about them by the AMP, carry a lower money laundering or terrorist financing risk. Where an AMP has determined that a customer presents a low risk of money laundering, based on appropriate, documented evidence, reduced CDD measures may be applied. Such customers might include:

– Customers who are employment–based or with a regular source of income from a known source which supports the activity being

undertaken; and

– Customers with a long–term and active relationship with the AMP.Regulation 37(1) 5.191 There are other circumstances where the risk of money laundering or terrorist financing may be lower. In such circumstances, and provided there has been an adequate analysis of the risk by the country or by the AMP, the AMP may (if permitted by local law or regulation) apply reduced CDD measures.

Potentially lower risk situations may be influenced by:

– Customer risk factors

– Country or geographic risk factors

– Product, service, transaction value/frequency or delivery channel

risk factors

5.192 Having a lower money laundering or terrorist financing risk for identification and verification purposes does not automatically mean that the same customer is lower risk for all types of CDD measures.”

Four key scenarios for using SDD:

- The customer is a publicly-listed company;

- The customer is a state-backed business;

- The customer is a company (or other structure) and you deem the UBO/s to be low-risk [example: another regulated AMP]; and

- The customer is a private individual [example: contemporary artist].

1. Publicly-listed companies

It makes sense that SDD applies, as the business has a whole host of reporting requirements to maintain their status. In this case, you needn’t:

- Obtain details relating to the company’s beneficial owners (therefore you needn’t conduct CDD on the UBO/s);

- Confirm the names of the Directors, Officers and Senior Management; nor

- Confirm the law to which the business is subject.

2. State-backed businesses

Sometimes, art buyers or consignors are funded by the state. One example seen in the UK is a ‘Royal Charter Company’. In this case, you might deem that the risk is lower, providing there are no other risks identified.

3. Company with low-risk UBO/s

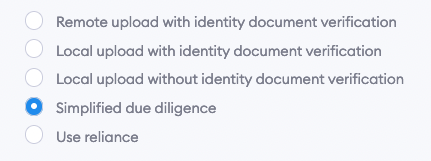

This is a combined scenario: you start by conducting Standard Due Diligence on the company, followed by Simplified Due Diligence on the UBO/s. For the latter and when using ArtAML’s platform, when it comes time to conducting CDD on the UBO/s, you can select ‘Simplified Due Diligence’ for identifying and verifying the customer (KYC, a.k.a. ‘Customer’)*:

*Be sure to still conduct AML with regard to the transaction (as opposed to the individual), using the “Transaction” module in ArtAML™. The two steps to Customer Due Diligence in our platform are: Customer (KYC) and Transaction (AML).

4. The customer is a private individual

Deciding upon the use of SDD is not to be taken lightly. The following clauses from the British Art Market Federation (BAMF) Guidance (June 2022) is informative:

Troubleshooting: SDD on artists and fellow Art Market Participant businesses?

In short, tread carefully. Just because another art business is regulated does not mean that it makes sense to conduct Simplified Due Diligence. An important point is that the business ownership and management can change, so relying upon previous Customer Due Diligence is not a smart choice, certainly not without confirming that ownership, structure, etc are still the same. As an example, it’s possible that a UBO associated with a high-risk jurisdiction has come onboard and EDD needs to be conducted – even if you’ve known the business itself for years.

Our take is to take a risk-based approach (as always), collect the company certificate and confirm with an official representative the UBO/s, Directors & Officers and senior management. You might screen the company for sanctions in the swiftly-changing landscape. Then for UBOs, determine what level of Customer Due Diligence to conduct for each individual, depending upon relationships and information available at the time. IF you deem simplified due diligence to be applicable for a UBO, you can select ‘SDD’ for the conducting of KYC on that person within ArtAML™.

Conclusion

If you use SDD, it’s important that you have recorded your decision-making and include screenshots and information collected to back-up this assessment.

In simple terms, the level of due diligence conducted is instructed by taking a risk-based approach. This can be guided by your AML Policy that outlines how you mitigate the risk of your business being the target of anti-money laundering / terrorist-financing activities, in addition to making assessments on a case-by-case basis.

__________

This article was updated in October 2022 to include information from the updated BAMF Guidance.

![ArtAML logo - transparent.png]](https://knowledgebase.artaml.com/hs-fs/hubfs/ArtAML%20logo%20-%20transparent.png?height=50&name=ArtAML%20logo%20-%20transparent.png)